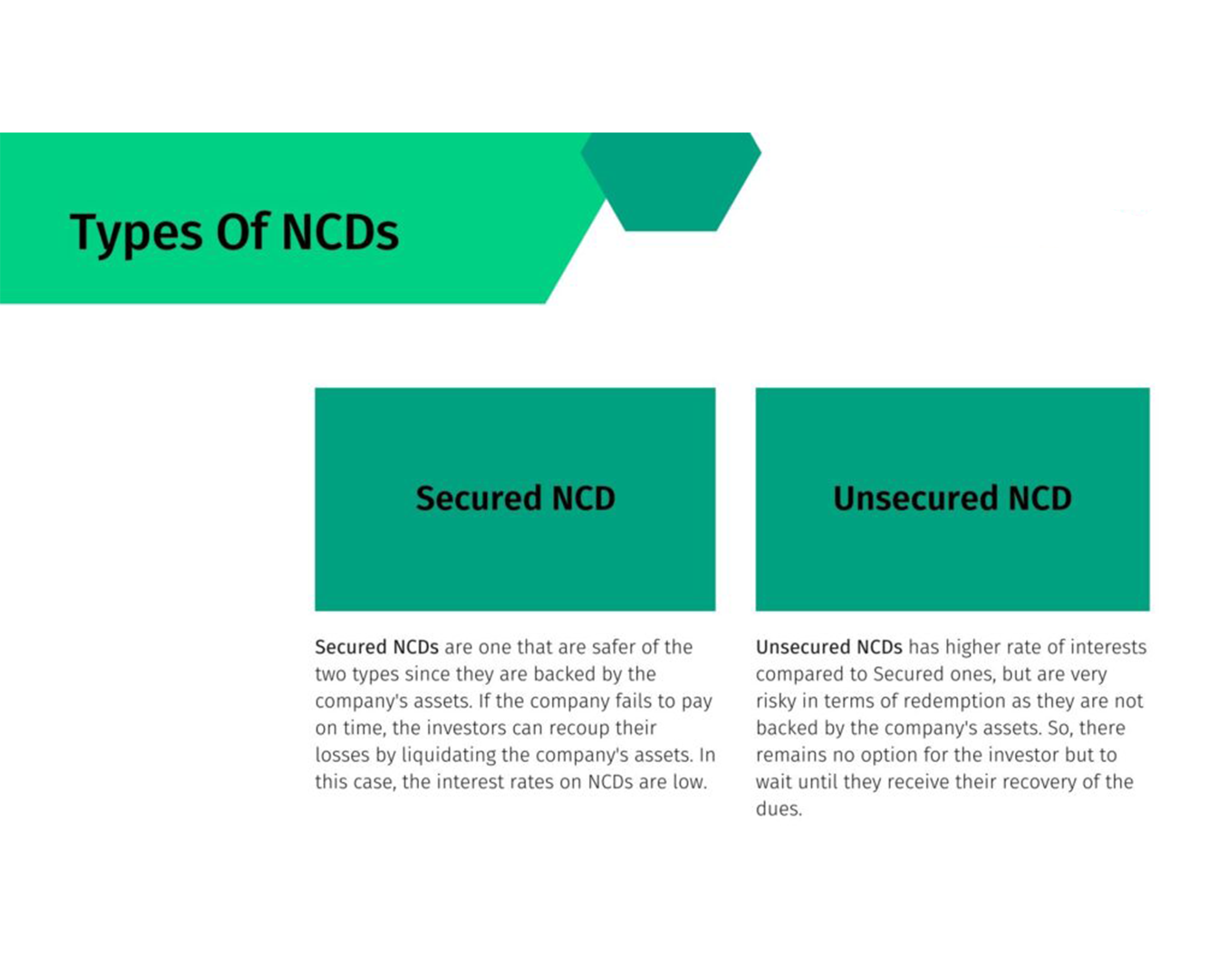

NCD (Non-Convertible Debentures) के प्रकार

1️⃣ Secured NCD * कंपनी की assets / property पर charge* Risk कम, Safety ज�...

Read More

1️⃣ Secured NCD * कंपनी की assets / property पर charge* Risk कम, Safety ज�...

Read More

✅Category Cat 1, Cat 2, and Cat 3 AIFs (Alternative Investment Funds) as defined by SEBI (Securities and Exchange Board of India): ???? Category I AIFPurpose: ...

Read More

A Smart Alternative for Borrowers and InvestorsIn recent years, Peer-to-Peer (P2P) lending has emerged as a revolutionary way for individuals and businesses to access funds without ...

Read More

Senior Secure Bonds vs Secure Bonds: Which One is Right for You?When investing in bonds, understanding the difference between Senior Secure Bonds and Se...

Read More

✅ राज्य सरकार बॉन्ड में निवेश के फायदे (Benefits of Investing in State Government Bonds) ...

Read More

Two primary methods of raising capital for a business, each with distinct characteristics, benefits, and drawbacks. ...

Read More

India's debt market holds immense potential, especially given its scope for growth and diversification. While the debt market is already significant, primarily driven by government bonds...

Read More

Real Estate NCD: A Real Estate Non-Convertible Debenture (NCD) is a type of fixed-income financial instrument issued by real estate companies to raise capital. NCDs are es...

Read More

A sovereign bond is a debt security issued by a national government to support government spending and obligations. Here’s a detailed breakdown of sovereign bonds ...

Read More

The terms "secure" and "unsecure" (often referred to as *"secured"* and *"unsecured"*) relate to the type of collateral backing a bond and the relative...

Read More

Bond ratings are categorized into different types based on the credit rating agencies' assessments of the issuer's ability to meet its debt obligations. These ratings are usually di...

Read More

> In the context of bonds, a "rating" refers to a credit rating that assesses the creditworthiness of the bond issuer. This rating is provided by credit rating agencies such ...

Read More

The yield on a bond is important for several reasons: 1. Return on Investment: The yield represents the income an investor will earn from a bo...

Read More

Invoice discounting is a financial solution used by businesses to improve cash flow by accessing funds tied up in their outstanding invoices. Here’s how it typically works:...

Read More

Strategies for Successful Bond Trading Bond trading can be a complex but rewarding endeavor. Whether you’re trading individual bonds...

Read More